Improving Insurance Claims using the iPhone

post by Chris Curran on April 6, 2010co-authored with Anand Rao

Is Claims Processing Getting Any Better?

How long does it take for your auto insurance carrier (or your own organization for the insurance professionals out there) to process a claim and how many people are involved in the process? Most insurance claims takes weeks, if not months to fully complete. In fact, the Bureau of Labor Statistics estimates that nearly 436,000 people were involved in 2008 in either processing insurance claims or as claims adjusters, examiners, and investigators.

In addition to the manual labor, the fraud associated with insurance claims is also a major issue in the industry. Research by the Insurance Research Council estimates that claim fraud and buildup (i.e., ‘padding up’ of legitimate claims) added between $4.8 billion and $6.8 billion in excess payments to auto insurance injury claims alone in the year 2007. This represented between 13% and 18% of total claims payments.

While the industry is getting better at processing claims and automating some of the back end activities, capturing and verifying the data at the ‘Point-of-Claim’ is still a major issue. Can innovative use of information technology come to the rescue of the claims industry?

Using the iPhone to Improve Claims

Think about all the people involved in reporting and processing a claim. First, the customer reports a claim by calling into the insurance company. The claim is first logged by the customer service representative - First Notice of Loss (FNOL) in industry jargon. Depending on whether the customer service representative is a generalist or a claims specialist, you might have a number of conversations to report the loss. Then an adjuster gets assigned to your claim. After a few hours (or days or weeks) the claims adjuster will assess the claim and file a report to their supervisor. Based on your policy, the amount of damage, and the amount of claims, you will receive either a denial or acceptance of your claim. The amount may be what you requested or something substantially lower. If you dispute the decision, the process goes on to another ‘exception process’ of reviews, investigations, and rulings - now spanning a larger group of people including the lawyers. Even if you accept the terms of the insurer, you still have to get the damage fixed and claim the amount. Needless to say a painful process adding to the original pain of the loss or damage to your auto or property.

We’d like to offer an idea based on a concept called augmented reality (AR). An AR system overlays computer generated information on a live picture, like the heads up displays found in planes and automobiles and the yellow first down marker used in football broadcasts.

What is really interesting about the complex idea of overlaying data on a live image is that we now have a consumer level device that can do it - the iPhone 3GS. Whats really cool about the iPhone is that it is in the hands of over 20 million people, application development is pretty straight forward and the percentage of business apps is very low - a platform ready made for some prototyping. Add to that the GPS, compass, accelerometer, camera and wireless capabilities, and you also have a pretty powerful augmented reality platform.

One example of an AR app that’s already out there is the New York Nearest Subway. If you hold it up on a street corner in New York it will overlay information and directions for the closest subway stops. This might seem like a pretty complicated development chore - dealing with all of the sensor data. Well, there’s an app for that too. At least one firm has developed an iPhone software platform called Layar on which you can add layers of information on top of the live image shown on the iPhone. So they’ve done a lot of the lower level work for you and you can just add information - ATMs and bank branch locations, claims centers, retailers who carry your product, product information by aisle - you get the idea.

Insurers like Nationwide, Progressive and Geico all have iPhone Apps to take pictures and report claims from the scene of the accident. Taking some of these apps to the next level of the AR world could be the next step.

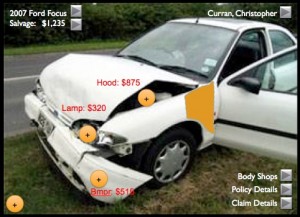

We sat down and brainstormed how augmented reality style app could help a claims adjuster process an automobile accident. Nothing fancy but we came up with a few ideas like the ability to recognize car makes/models, show prior damage reported directly on the image of the car, the ability to mark damaged parts of the car to get repair quotes and to find the closest repair facilities. Getting all of this information at the ‘point-of-claim’, assessing and adjudicating the claim makes the process relatively painless for the consumer, avoids fraud and padding substantially, and streamlines the claims processing immensely.

Although, these apps are initially being used in the personal lines auto sector, there is no reason why this could not be expanded to other lines - fire and flood damages to property and content or industrial accidents in the commercial sector. The ubiquity of the iPhone and the information layering of AR apps will make such applications commonplace in the next couple of years.

Maybe this simple mockup will give you some ideas of your own?

Pingback: Tweets that mention Improving Insurance Claims using the iPhone — CIO Dashboard -- Topsy.com()

Pingback: uberVU - social comments()

Pingback: Are IT Leaders Also Social Media Leaders? — CIO Dashboard()

Pingback: 5 IT Innovations for 2011 — CIO Dashboard()